Employer contribution payroll tax calculator

Federal Payroll Non-Tax Laws Regulations. The calculator includes options for estimating Federal Social Security and Medicare Tax.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Ad Compare This Years Top 5 Free Payroll Software.

. Social Security accounts for 124. 2020 Federal income tax withholding calculation. The employer cost of payroll tax is 124.

Payroll tax actually includes two different taxesSocial Security and Medicare folded into one known as the Federal Insurance Contributions Act FICA. Multiple steps are involved in the computation of Payroll Tax as enumerated below. If you receive tips in your paycheck this calculator will help you estimate the withholdings every pay period.

Our calculations assume that the employee has already received the tip. The FICA for Federal Insurance Contributions Act tax also known as Payroll Tax or Self-Employment Tax depending on your employment status. The charts below show the employer contribution rates while our contribution calculator helps you to estimate how this will look for you and your Massachusetts workforce.

All Services Backed by Tax Guarantee. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. How Contributions are Calculated.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Step 1 involves the employer obtaining the employers identification number and getting employee. Subtract 12900 for Married otherwise.

Federal tax rates like income tax Social Security 62 each for both employer and employee and. Ad Compare This Years Top 5 Free Payroll Software. The tax rates are updated periodically and might increase for businesses in certain industries that have higher rates of turnover.

Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much. Our online income tax calculator will help you work out your take home net pay based on your salary and tax code. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

SUTA tax rates will vary for each state. Both employers and employees are responsible for payroll taxes. Free Unbiased Reviews Top Picks.

Ad Payroll So Easy You Can Set It Up Run It Yourself. This text contains the exact language of the payroll-related sections of federal non-tax laws and regulations from the United States Code and the. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

After you have determined that you are an employer a trustee or a payer and have opened a payroll program. Work out your take home pay with our online salary calculator. Free Unbiased Reviews Top Picks.

Changes to the rules for deducting Canada Pension Plan CPP contributions. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Paycheck Calculator Take Home Pay Calculator

Fjio0zhlyhmodm

How To Calculate Payroll Taxes In 5 Steps

How To Calculate Payroll Taxes In 5 Steps

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Income Tax

6 Free Payroll Tax Calculators For Employers

How To Calculate Payroll Taxes Methods Examples More

Employer Payroll Tax Calculator Incfile Com

Paycheck Calculator Take Home Pay Calculator

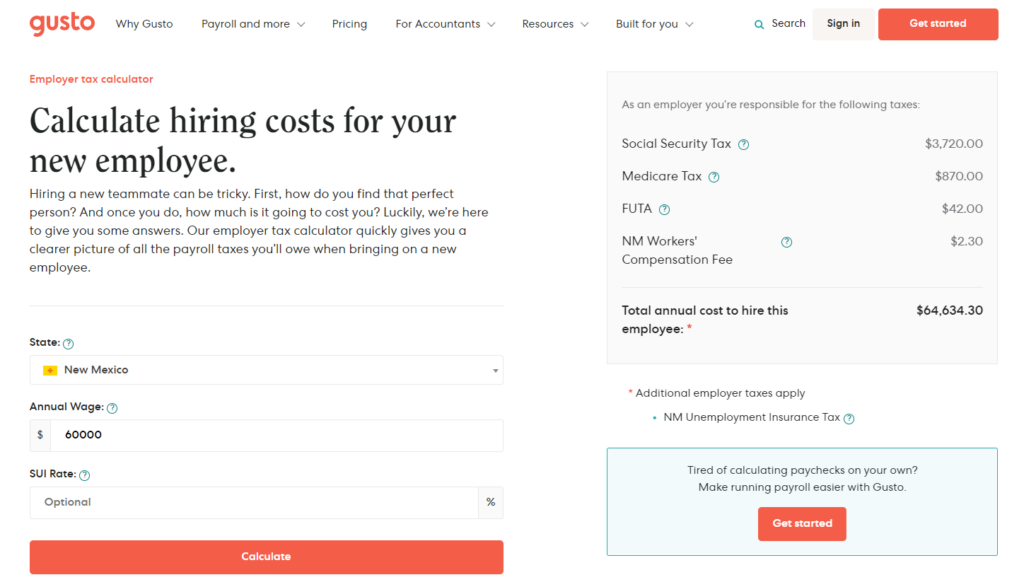

What Are Employer Taxes And Employee Taxes Gusto

Payroll Tax Calculator For Employers Gusto

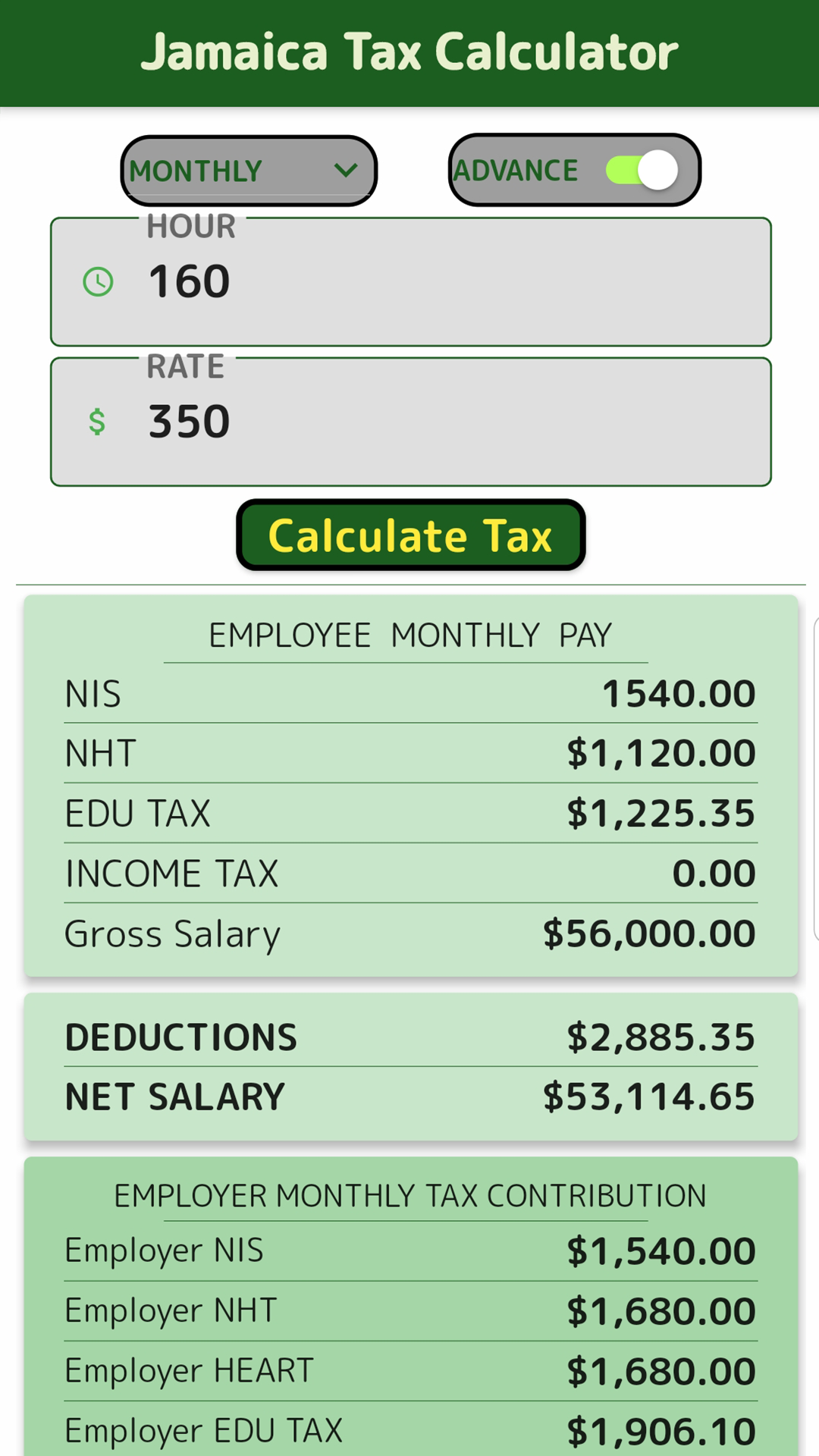

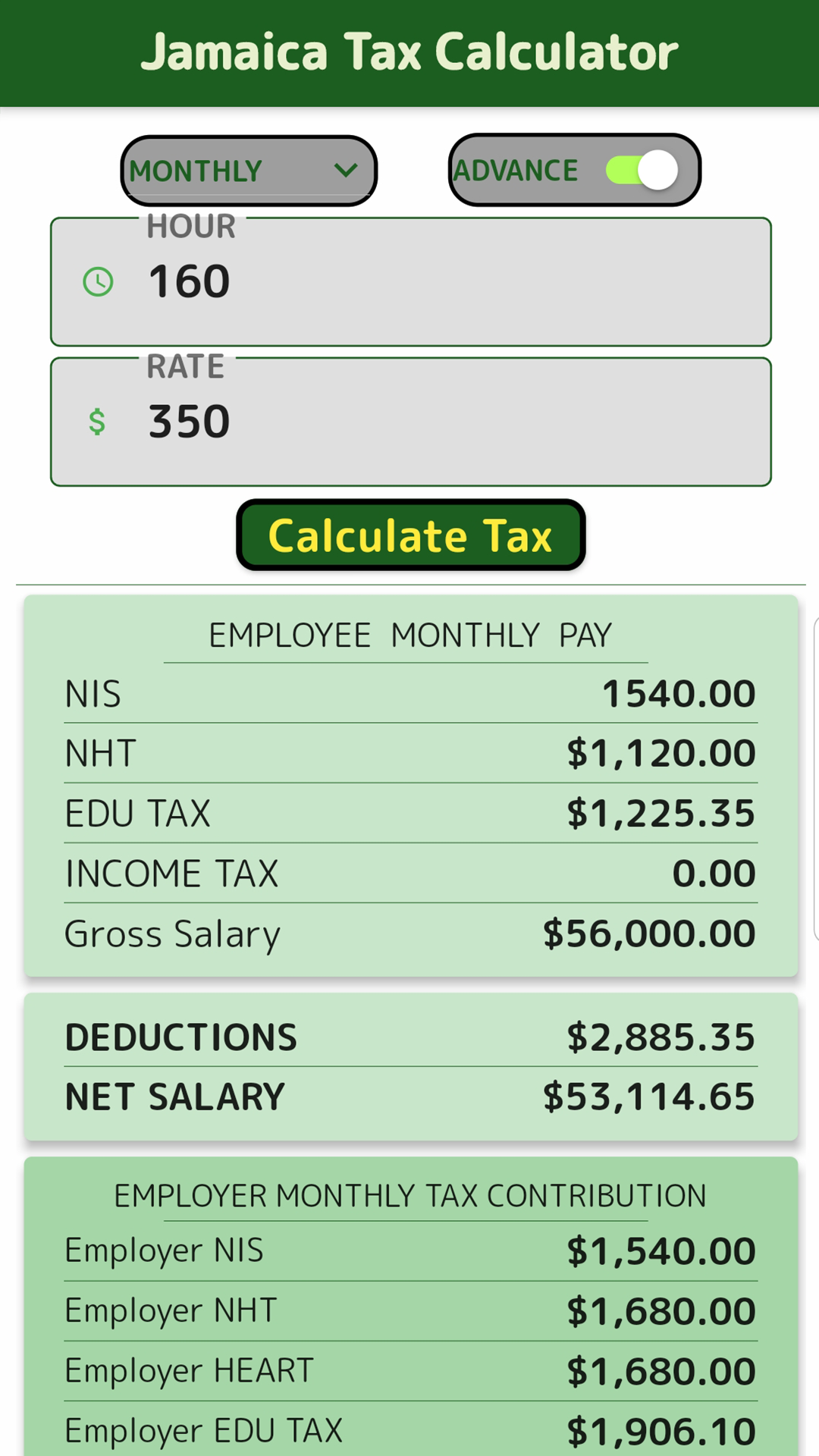

Jamaica Tax Calculator It S All Widgets

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Solved W2 Box 1 Not Calculating Correctly

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Vs Income Tax What S The Difference